My husband was flipping channels recently (as men like to do) and found the Me-TV Network and the This TV Network. Both channels are running those old shows from the ’60s, like Leave It To Beaver and Father Knows Best. Do you remember those magical shows where families could live on just the dad’s income and mom never had to work?

My husband was flipping channels recently (as men like to do) and found the Me-TV Network and the This TV Network. Both channels are running those old shows from the ’60s, like Leave It To Beaver and Father Knows Best. Do you remember those magical shows where families could live on just the dad’s income and mom never had to work?

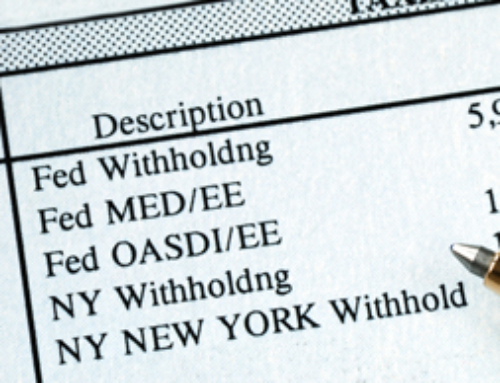

Life is not like that today. If you’re like many of us, you don’t just have one job, you also have a business on the side—or you’re generating income on the Internet. How do you deal with reporting that income and paying taxes on your self-employed or side income?

Report it all!

That’s it. This article is done.

Oh, you want details? OK!

Types of income and how to report it

What income are we talking about? All of it. Yard sales, eBay sales, affiliate revenues from your website, Google AdSense income, lottery winnings—any sort of money that crosses your palm, physically or virtually. For additional details, check out Internal Revenue Code Section 61, which describes all kinds of income. You can find more information in clearer terms in IRS Publication 17.

When you pay your taxes, much of that miscellaneous income will end up getting reported on page one of your Form 1040, on line 21 – Other Income. This is the line you use for income that has nothing to do with a business or investments.

Online or offline sales of personal property

If you are selling off personal property at yard sales or on eBay or Craigslist, report the income on Schedule D. Don’t worry. You won’t be paying taxes on it. You’re probably selling your household furniture, knick-knacks, toys, clothes, and so on for pennies on the dollar. Report the cost as being the same amount as the total amount for which you sold the items. (Sorry, you don’t get to pick up a loss when you sell personal items.) Keep in mind, however, that if you sell things at a profit, you will have to pay taxes on that profit.

Naturally, if your online sales are based on products you bought specifically to sell online, they are not your personal possessions. You have now entered the realm of paying taxes on business or self-employed or hobby income.

Do you have a business or a hobby?

If you have a profit motive, you need to report all the income and expenses on Schedule C. You can prove that you have a profit motive by actually working to make your business successful—generating sales, doing marketing, keeping records, and other things like that.

The IRS looks at your business as a hobby if you’re clearly dabbling at it. What does dabbling look like? Simple—you’ll show lots of expenses, very few incidences of sales, and no evidence you’re trying to actively generate more sales. In that case, report your income on Form 1040, on line 21 – Other Income.

On the other hand, your expenses will end up on Schedule A as miscellaneous itemized deductions. Expenses are limited to your income and are reduced by 2 percent of your Adjusted Gross Income. This means you won’t get much benefit from the deductions.

Wow, that all sounds pretty comprehensive. Does that mean you have to report every dollar that ever comes into your hot, little hands? No. Some things you get are gifts and others are freebie promotional stuff that everyone gets.

But at least you’ve started thinking about the money that comes into your hands, right?

Eva Rosenberg, EA, is the publisher of TaxMama.com®, where your tax questions are answered. She teaches tax professionals how to represent you when you have tax problems. She is the author of several books and e-books, including Small Business Taxes Made Easy. Follow her on Twitter: @TaxMama