Foreclosures and short sales aren’t the only story in the housing market. Historically low interest rates should be a sign for existing homeowners that it might be time to refinance.

Foreclosures and short sales aren’t the only story in the housing market. Historically low interest rates should be a sign for existing homeowners that it might be time to refinance.

Freddie Mac released the results of its Primary Mortgage Market Survey today and the results are good news for anyone looking to refinance: fixed rate mortgage rates are currently the lowest on record. Following the Federal Reserve’s announcement of its Maturity Extension Program, fixed mortgage rates fell to all-time record lows, averaging 4.01 percent for a 30-year fixed rate and 3.28 percent for a 15-year fixed rate. Adjustable rate mortgage (ARM) interest rates remained at or near last week’s lows, averaging 3.02 percent for a 5-year ARM and 2.83 (up from last week’s 2.82) percent for a 1-year ARM.

At this time last year, average rates were 4.32 percent for a 30-year fixed and 3.75 percent for a 15-year fixed. That’s quite a drop, considering we thought those rates were about as low as they could go.

With rates continuing to fall, many consumers have mixed feelings about refinancing their mortgages. According to Mona Marimow, Senior Vice President at Lending Tree, people who would normally jump at the chance to lock in a lower rate are hesitant because rates could fall even lower. This fear of falling rates results in what she calls “a sort of pre-traumatic stress.” While buyers have traditionally experienced buyer’s remorse after taking out a mortgage and wondering if they got the best rate, today’s consumers put off refinancing due to the fear and anxiety surrounding the mortgage market. After all, if they put it off long enough, interest rates may get even lower.

This might not always be the case; it’s hard to know for sure when rates will begin to climb again and putting off refinancing too long might mean missing historically low interest rates completely. Marimow points out there’s more to refinancing than interest rates – consumers must also take into account loan terms and fees associated with refinancing. If interest rates, including fees, add up to monthly savings and loan terms are reasonable, renegotiating your mortgage might be the best option. And if rates go lower during the term of your loan, it’s not out of the question to refinance again.

If you decide to go the refinancing route, make sure you’re prepared.

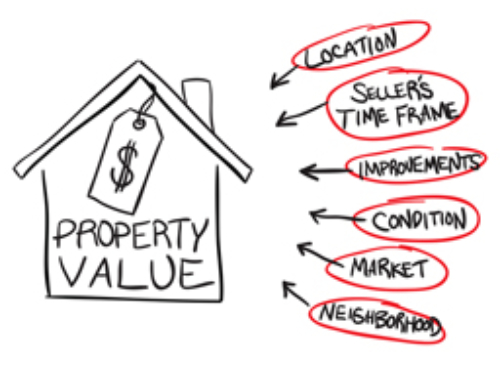

- Be aware of the real value of your home and don’t let emotional attachment blind you to the hit your home may have taken when the bubble burst. Providing your lender with an inflated home value will only lead to disappointment at the closing table.

- Take into account all the fees associated with refinancing and make sure you will actually be saving money.

- Don’t overlook shorter-term loans which may reduce the amount of interest you pay.

- Make sure you know what documents will be required for you to refinance, and make a list of everything you need to bring with you to the negotiating table.

Don’t let a fear of falling rates keep you from refinancing, but make sure to take into account everything that goes along with it before deciding if it’s right for you.