There are so many wonderful benefits to having a job—paid vacation time, sick pay, bonuses, perhaps even pensions and medical plans. Plus, most jobs let you have regular hours and weekends off.

But some of us are compelled to be our own bosses. We are lured by the feeling of freedom, the right to control our own time, and the right to turn down work or clients or customers who are displeasing.

What do self-employed folks do wrong?

Licenses – Without a full legal and tax department, sometimes it’s hard to stay on top of all the licensing and administrative obligations of small businesses. Call your city clerk’s office and your secretary of state’s office (or explore their websites) to find out what licenses apply to you.

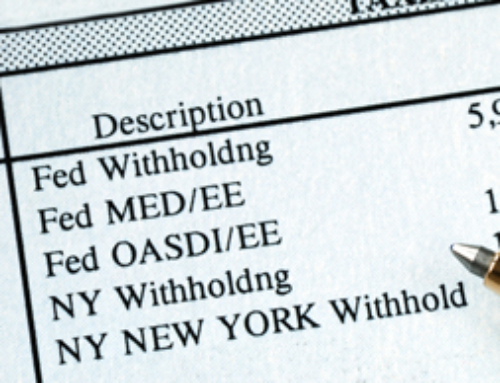

Taxes – Most small businesses need to register with their state sales tax department and don’t realize it. If there are employees, businesses need to get both their IRS and state taxpayer identification numbers. And they need to file reports quarterly and/or annually.

Employees – Due to the complexity of dealing with payroll tax issues, many small businesses avoid hiring employees. Instead, they treat everyone who works for them as a freelancer. That can turn into a costly problem—especially when workers are let go or leave. Some workers file for unemployment, triggering a very unpleasant audit. The solution is to do it properly in the first place. It’s cheaper in the long run.

Time management – Are you really making the best use of your time? Think about it. If you didn’t have to do some of those time-consuming administrative tasks, how much more money could you earn? It may be cheaper to hire help, or to outsource some of your work, than to do it all yourself.

Advice – In the first chapter of Small Business Taxes Made Easy, I advise you to build an advisory team. Some people think that’s onerous or expensive. But think about it—what could you accomplish if you could pick the brains of key people in your business community? They could open doors for you, help you find better prices, refer customers or clients—and get you financing or investors. Better yet, you could get the benefit of their experience. I think that not building such a team is one of the biggest mistakes made by small businesses. (For additional insight, check out an interesting post made by fellow blogger Roger Wohlner last month about his colleagues, what they talk about, and the advice they give each other.)

Tax Planning – Listening to a commercial about setting up an LLC is not tax planning. In fact, it’s often the worst thing you can do for your business. You need a good tax professional and a great business attorney on your team. Meet with them for planning purposes at least once a year. Twice is better. Paying them a few hundred dollars a year can save you thousands!

Be good to yourself. Think about your business and how to make better use of your time or money. Learn from my mistakes—and you’ll be happier and more successful.

Eva Rosenberg, EA, is the publisher of TaxMama.com®, where your tax questions are answered. She teaches tax professionals how to represent you when you have tax problems. She is the author of several books and e-books, including Small Business Taxes Made Easy. Follow her on Twitter: @TaxMama

Teens and Taxes: Do I Need to File Taxes?

Tax Differences between Buying and Renting

Writing Off the Family Vacation