Are You Optimizing Your Retirement Contributions?

Are You Optimizing Your Retirement Contributions?

We all know two facts of old age:

- Social Security won’t be able to support us when we retire.

- We will be living longer.

What will you do to ensure your retirement is financially secure? Let’s start with a few definitions.

Definitions: Deferred-Tax and After-Tax Contributions

- Deferred-tax contributions reduce your current taxable income. You don’t pay any IRS or state income taxes on those contributions, or on the earnings in these accounts. You will pay taxes later, when you draw the funds from your retirement account. These accounts include IRA, 401(k), 403(b), Keogh, SIMPLE, SEP, and defined-contribution plans, among others

- With after-tax contributions, you pay tax today. You won’t pay tax on your contributions when you take them out. However, there are two more options for the earnings on these funds:

- Roth accounts grow tax-free, and you can draw the earnings tax-free if you wait at least five years and you’re retired or permanently disabled. These accounts include the Roth IRA and the Roth 401(k).

- IRA or retirement accounts grow tax-free. You will pay tax on the earnings when you draw them. These accounts include the nondeductible IRA, annuities, and such.

Savings in Your Business or on the Job

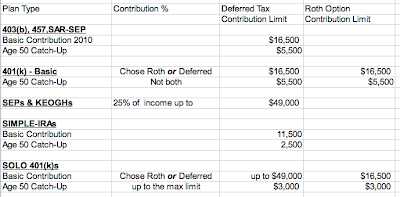

If you’re in business for yourself, or when your employer offers you a retirement plan, it’s likely to be one of these, with the following contribution limits for 2010:

On Your Own

For 2010, you may fund an IRA or a Roth IRA up to $5,000 for yourself and your spouse, up to your combined income limits. If either of you are age 50 or over, you may add another $1,000. Couples who are eligible for a retirement plan at work may face income limits. If only one partner is covered, there are other limits. Naturally, Roth IRA contributions are limited by your income, too.

When your children work, whether for you or for other employers, they are eligible to fund IRAs to those same limits, too.

More Incentives

Deferred-tax options save you money right now. They make it possible to afford the savings you might not otherwise make. When you’re in a 20 percent tax bracket, consider contributing 5 to 10 percent of your wages. You would have paid that in taxes anyway if you had not invested the money in your future.

If you are married filing jointly with income under $55,500, you might be eligible for a Retirement Saver’s tax credit of up to $1,000. Read chapter 5 of IRS Publication 590 to see if you qualify.

The best incentive of all is that if you invest your money safely, it will still be there when you retire. If invested skillfully, it will have grown enough to support you in the style you never enjoyed when you were a workaholic.

Eva Rosenberg, EA is the publisher of TaxMama.com, where your tax questions are answered. Eva is the author of several books and ebooks, including Small Business Taxes Made Easy. Eva teaches a tax pro course at IRSExams.com.

Read More:

Weird Taxes Affecting You Right Now

Estate Tax Update: How Will the Estate Tax Affect You?

The Nanny Tax: How to Pay Nannies, Babysitters, and Home Help

Tax Repercussions of Divorce

Tax Consequences of Unemployment