Is Now the Right Time to Buy a Vacation Home along the Gulf of Mexico?

Is Now the Right Time to Buy a Vacation Home along the Gulf of Mexico?

Week after week, the Gulf oil spill drama has dragged on, dragging down the fortunes of millions of residents and small-business owners with it.

Meanwhile, Ken Feinberg, who oversaw the 9/11 fund payments, has been appointed pay czar for the Gulf oil disaster, with the goal of making sure more victims are paid more money on a timelier basis. The federal government has billed BP $100 million for cleanup costs, and Michelle Obama recently visited the area to show off how many beaches have not (yet) been spoiled by oil and tar balls.

Tar balls or not, if you own a primary or vacation home anywhere along the eastern half of the Gulf, you have to be worried about the long-term implications of the Gulf oil spill:

- Gulf Coast homeowners say vacation bookings are down sharply from a year ago.

- Property prices are falling as fewer buyers are considering purchasing property along the shoreline.

- Foreclosures are mounting as vacation homeowners struggle to make payments in the wake of cancellations.

- Tourism dollars in states along the Gulf have shrunk, even as states spend millions of dollars promoting themselves.

That’s a lot of negative news, and indeed, some buyers are staying away. However, the contrarian in me wonders if now is the right time to buy a vacation home along the Gulf of Mexico.

Whenever you go into a troubled location, you have to be careful. Here are a few things to think about:

What is the timeline for your investment? After Hurricane Andrew struck South Florida, in 1992, it took nearly a decade for the area to rebuild and get back to normal. The Gulf states, and in particular New Orleans, are only now beginning to recover from Hurricanes Katrina and Rita. If you make this investment, think about the timeline in terms of decades.

Will this purchase stretch you financially? Are you concerned about your job security? Or do you feel like you have a lot of extra cash to play with? In uncertain economic times, you don’t want to push yourself to the brink financially.

Do you need a mortgage? If you pay with cash, then you’ll only have to worry about real estate taxes and insurance. If you need a mortgage, and you’re counting on renting the property to cover some or all of your expenses, you’re more susceptible to fluctuations in vacation traveler demand. Also, if you need a mortgage to purchase the property and you’re buying in a building that’s full of foreclosures, the property may not even qualify for financing.

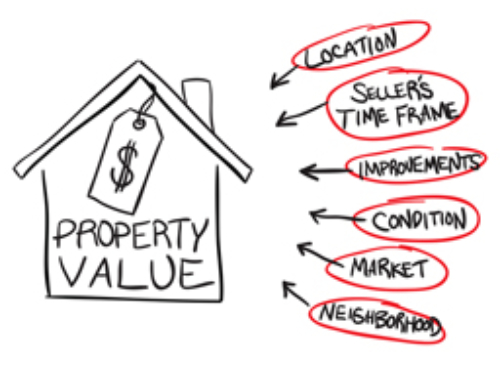

Can you purchase a quality property at a rock-bottom price? There will be people whose instincts tell them to flee at the first sign of trouble. That means there could be an excellent long-term investment just waiting for a savvy buyer. Find out what property is worth today, post-spill, and then negotiate for a price you feel reflects the risk you’re willing to take.

Remember: just because a piece of property is cheap doesn’t mean it’s a good deal. To really determine if now is the right time to buy property on the Gulf Coast, you’ll have to pull out your pencil and paper and start crunching numbers.

Ilyce R. Glink is the author of several books, including 100 Questions Every First-Time Home Buyer Should Ask and Buy, Close, Move In!. She blogs about money and real estate at ThinkGlink.com and at the Home Equity blog for CBS MoneyWatch.

Ilyce R. Glink is the author of several books, including 100 Questions Every First-Time Home Buyer Should Ask and Buy, Close, Move In!. She blogs about money and real estate at ThinkGlink.com and at the Home Equity blog for CBS MoneyWatch.

READ MORE:

The Best Way To Value Investment Property

How to Find a Great Real Estate Agent

Will the Real Estate Summer Slowdown Mean Lower Prices?

No More Home Buyer Tax Credits: Is Now a Good Time to Buy a House?