Updated September 9, 2019. Natural disasters are forcing homeowners and renters to file insurance claims in record numbers – and for amounts that are astronomical. But, not every claim is being approved. Here’s what you should do to prepare for a physical catastrophe caused when a natural disaster strikes.

Man-made catastrophes, like fires and crashes, are bad enough. But they’re nothing compared to the damage Mother Nature can cause.

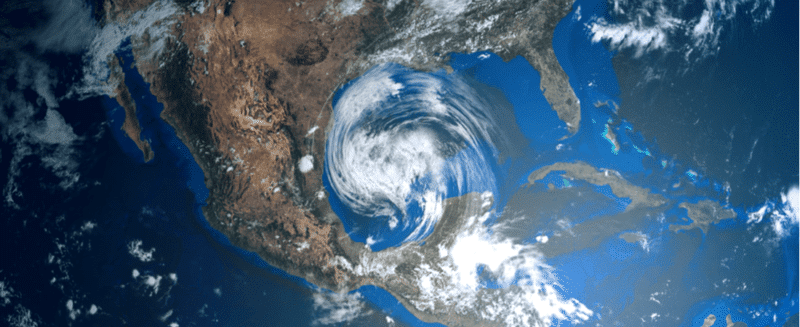

Natural disasters-tornadoes, typhoons, tsunamis, thunderstorms, hurricanes, floods, earthquakes, volcanic eruptions, wildfires, mudslides, landslides-can strike at any time.

With the looming threat of natural disasters, how does anyone leave the house? The trick is to understand what you’re most at risk for and prepare for it as best you can.

Natural Disaster Insurance Claims: Hurricane Prep

If, for example, you live in an area prone to hurricanes, you can take important precautions to protect your property, such as investing in a backup sump pump, keeping your valuables raised up off the floor, and perhaps investing in hurricane shutters.

When it comes to insuring your possessions, you’ll probably want to buy flood insurance, even though you might have to pay more for it due to the increased risk of flooding in a hurricane-prone area.

Hurricane season, while incredibly destructive, is a period of seven months, from June 1 to December 1. Other natural disasters can happen at any time, anywhere. My office in historic Sleepy Hollow on the Hudson River in Westchester County, New York, was struck by a tornado four years ago. The unexpected cyclone hit many buildings in the area and dropped a hundred-year-old tree on our roof. Luckily, no one was injured, and fortunately, we had insurance coverage to repair our office. Many of our local clients had to file claims to repair damages to their home.

Natural Disasters: Preparing for Unexpected Insurance Claims

The best thing you can do to prepare for a natural disaster is create a record of your home and your belongings.

And yet, according to a survey conducted by International Communications Research (ICR) on behalf of the Independent Insurance Agents & Brokers of America (IIABA), 67.7 percent of households have not created a photo library or a video file of the personal contents of their home.

Last winter, we had a massive snowstorm that caused trees to hit lots of fences and roofs in the area. The advice we gave our clients then, which is the same advice we give any disaster victim, is PHOTOS, PHOTOS, and MORE PHOTOS.

You can call your agency first and get an estimate, but photo documentation is what’s going to help when you file your insurance claim.

Natural Disaster: How to Document Your Home and Belongings for Insurance Claims

Creating simple photo documentation of your home and your belongings is one way to make filing an insurance claim so much easier. Follow these best practices to become your insurance agent’s most prepared client:

- Inventory your home with photos and video. Take photos or video of everything of value. Then do some sweeping shots that show where artwork is hung on the walls and how the furnishings are laid out in the rooms.

- Store your photo/video inventory in the cloud. While you might want to use a thumb drive (and you can get extremely large thumb drives these days, you’re better off storing your home inventory in the cloud, either in Google drive, Apple or Microsoft cloud. You can also put a copy of your photographic records in photos.google.com, which will allow you to store videos as well. If you have a list, you can take a picture of that and store it.

- Maintain receipts of major purchases, and update your inventory annually. Be sure to keep photos in a waterproof filing cabinet. Better yet, scan them into your computer and keep a copy off-site.

- Compile a list of all insurance policy numbers and contact information for your agent and insurance carriers. Be sure to have the insurance companies’ emergency numbers.

- Make sure your roof, gutters, doors, windows, and basement are storm-proof. Your home should be as watertight as possible.

- Have a first-aid kit easily accessible. Costco, Sam’s Club, and home-improvement stores sell inexpensive first-aid kits that can help with most medical emergencies.

- Keep your insurance and estate documents in an easily accessible location. If you need to get out of your house quickly, you’ll want to be able to grab the important stuff, if possible. (Be aware of evacuation routes in your community, so you know which roads to take.)

The Centers for Disease Control and Prevention (CDC) and the Federal Emergency Management Agency (FEMA) provide comprehensive information about disasters, preparedness, and recovery to avoid extensive injury and/or illness.

Natural Disasters: 4 Insurance Policies You Should Consider

Depending on where your home is located and the natural disasters most likely to strike, consider the following insurance policies:

- Homeowner’s insurance. Typically required by your lender, homeowner’s insurance protects your dwelling and its contents against windstorm and fire. Depending on your policy, other disasters might be covered. Floods (also referred to as “rising tides of water”) are usually specifically excluded. Read my post on homeowner’s insurance for more details.

- Commercial property insurance for businesses or office space. This will protect you if your office is damaged in a man-made or natural disaster (even if you don’t own the property). You can also buy insurance that will reimburse you for lost business or for temporary office space you must rent while your office is being repaired.

- Flood insurance. Read my recent post on flood insurance and how to price it.

- Earthquake insurance. Earthquake insurance is extremely expensive, and you might be better off self-insuring rather than buying an earthquake insurance policy. But if you’re right on a fault line, this policy might be worth buying.

Read More about Natural Disaster Insurance Claims

Linda Rey is a licensed insurance agent at Rey Insurance with a broad spectrum of expertise in life, accident, health, property, and casualty insurance, as well as retirement planning and college funding strategies.